The Main Principles Of Trading Indicator

Wiki Article

The Single Strategy To Use For Trading Indicator

Table of ContentsGet This Report about Trading IndicatorThe 5-Second Trick For Trading Indicator6 Easy Facts About Trading Indicator Explained7 Simple Techniques For Trading IndicatorThe Buzz on Trading IndicatorOur Trading Indicator PDFs

If you're obtaining a 'buy' signal from an indicator and also a 'market' signal from the price action, you require to utilize various indications, or various time frames up until your signals are validated. An additional point to remember is that you should never forget your trading plan (TRADING INDICATOR). Your regulations for trading should constantly be implemented when utilizing signs.Or, if you're prepared to start trading, open a live account.

Each time period has an equivalent bar. An eco-friendly bar reveals a price increase throughout the period, and a red bar shows a rate decline.

Excitement About Trading Indicator

High volumes may indicate that a movement in cost is considerable, while reduced quantities may suggest that an activity in rate is trivial. reveals the typical closing price over a time duration. For instance, any type of given point on a 20-day moving average shows the average of all closing costs from the previous 20 days.It can also help in reducing the impact of temporary cost changes. By contrasting MAs for different time durations, experts may have the ability to recognize cost trends gradually. is similar to the relocating average (MA). Both reveal the typical closing price over a period. Unlike MA, EMA places even more weight on recent information.

Experts generally compare EMAs for various time periods to aid figure out whether cost fads will proceed. This indicates that it evaluates the price at which prices increase and also fall.

The Single Strategy To Use For Trading Indicator

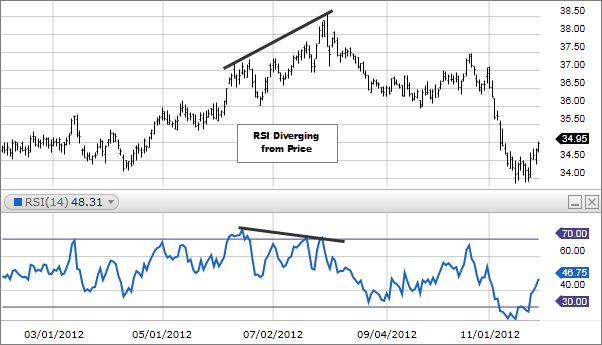

Experts generally think about a property overbought if its RSI is over 70, as well as oversold if its RSI is listed below 30. Our RSI makes use of, which aids remove rate fluctuations to make it much easier to identify patterns. As opposed to comparing rates to the relocating standard (MA), Wilder's smoothing makes use of the rapid relocating average (EMA).Indicators are a set of tools put on a trading chart that assist make the marketplace a lot more clear. For example, they can confirm if the marketplace is trending or if the marketplace is ranging. Indicators can also supply particular market info such as when a property is overbought or oversold in an array, and also due for a turnaround.

Leading signs can supply signals ahead of time, while lagging indications are usually made use of to verify the cost action, such as the strength of a fad. If the cost action has actually rapidly climbed as well as then starts to slow, a leading indication can description register this modification in momentum as well as thus give a signal that the possession may be due for a turnaround.

Trading Indicator - Questions

They are called delayed signs since they drag the price activity. Indicators create click to read more trading signals and each indication does this in different ways relying on exactly how the indicator calculates the rate action to provide the signal. They come under two more classifications: Trending indicators that function best in trending markets Oscillating/ranging signs that function best in ranging markets The trend on a graph, in addition to its strength, is not constantly apparent and also a trending sign can make this more clear.

Trending signs tend to be delaying in nature and are utilized to recognize the stamina of a trend, as well as help discover entries as well as exits in as well as out of the marketplace. Trending signs can therefore allow an investor to: Determine whether the marketplace is in a pattern Determine the instructions and also strength of that fad Help discover access and departures right into and out of the marketplace When the rate is moving in an array, an oscillating indication aids to determine the upper and also reduced boundaries of that variety by revealing whether something is overbought or oversold (TRADING INDICATOR).

Trading Indicator - Truths

The sort of indicators being made use of depends on the trading system, as well as inevitably comes down to the choice of the investor. The kind of indication you use is up to the investor's choice; however oscillating signs work in ranging markets, while trending indications are useful in trending markets. If you favor to trade in ranging markets, then oscillating signs, such as the stochastic, product channel index or the family member toughness index, will certainly be useful to assist make trading decisions.Incorporating trending and also oscillating indicators to use in different market conditions is valuable. Market conditions constantly transform from ranging to trending and back again, therefore you can utilize each sign according to its toughness. In a varying market, the oscillating indication stochastic is extra useful In a trending market, the trending indicator moving average hop over to here is better Once it ends up being clear exactly how helpful signs can be, there can be a tendency to use too numerous signs on one chart.

Report this wiki page